Construction Loan Calculator

Our construction loan calculator helps you in estimating your construction cost. It can give you the monthly payments during your home construction project, and the monthly loan payments after you are done with your construction. It can also estimate the (Federal Housing Administration) FHA, (United States Department of Agriculture) USDA, and VA construction loans.

How Do You Calculate a Construction Loan?

First you need to estimate the cost of your land, the cost of construction, and your down payment to calculate your construction loan. For example, if your land costs $150,000 and you estimate your home construction to cost around $300,000, you need $450,000 to complete your project. You need to provide 20% down payment for the construction loan. After paying $90,000 for a down payment, you will get a construction loan of $360,000. This loan calculator can help you determine how much you can get as a loan and calculate your monthly payments related to your loan.

The location of the land is very important because the cost of land largely depends on it, but it can be determined before applying for a construction loan. The cost of construction is very difficult to determine accurately, but it is still possible to estimate how much funds your construction requires. In 2023, the average cost to build a house in the U.S. was around $284,000, ranging between $109,000 and $450,000. The average price per square foot of a house to build is around $160, which may cost as much as $550 in some cases. The price of the construction depends on the square footage, materials, project complexity, and local wages.

What Is a Construction Loan?

A construction loan involves borrowing funds to finance your home construction project. It is a short-term loan that is eventually either paid back in full or refinanced into a conventional mortgage. Construction loans tend to be different from other types of loans because they require a plan and possibly a licensed constructor who would be involved in this process. Construction loans are short-term loans that are usually issued for up to one year. They have a high interest rate because these loans are not backed by collateral and are considered risky. In addition to that, construction loans tend to have an adjustable interest rate, which means that the interest rates may change as the prime rate changes.

How Do Construction Loans Work?

One of the major differences between a construction loan and a conventional mortgage is that a construction loan does not have collateral backing it. Since there is no collateral provided, the lenders require quite a bit of supporting documentation that outlines the nature of the construction, a clear budget, and a plan. This means that the borrowers have to clearly plan out the whole construction project before applying for a loan. Once you have all proper documentation and a licensed contractor, they may be able to apply for a construction loan.

Once the construction loan is approved, they can start working on the project. Construction loans are structured differently than normal loans. In traditional mortgages, the borrower receives the funds and pays back the interest and principal in installments. Whereas in construction loans there is no collateral backing the loan, the lender only provides portions of the loan to the contractor directly. Once the contractor receives the money, they can complete the part of the project that is meant to be completed using the allocated money.

Construction Loans Process

At every stage of a home building process, an inspection agent from the lender analyzes the progress and will release funds for the next step of the process. Major inspections will include building the foundation, home framework, roofing, and lastly, finishing. Each stage will have a different amount of funds disbursed to the contractor directly. At the end of the construction, all funds required will be disbursed, following which the borrower must determine whether to pay back the amount or refinance into a mortgage.

Types of Construction Loans

Construction loans are different from conventional mortgages. There are four distinct types of construction loans that have a similar purpose but differ in terms and conditions. They may look similar, but the details of the loan and what happens after it expires differ, so it is important to understand how each type of construction loan works to get the best option for a specific project and financial situation.

Construction-Only Loan

Construction-Only loan has a similar structure as an interest-only loan with a balloon payment at maturity. It implies that the borrower will have to pay interest-only payments while the construction is in progress and will pay the remaining principal in one payment at the end of the construction. This is a risky loan because it makes the borrower responsible for a large one-time payment. It is possible to get a mortgage on the house to pay off the construction loan. In this case, the borrower will have to pay closing costs twice, one for the construction loan and another for the mortgage. They are paid twice because you will have to get two separate financial products: a construction loan and a mortgage.

How Construction-Only Loan Works

This loan provides flexibility to the borrower because they may pay off their construction loan on their own. In this case, the borrower will be able to save money on interest in the long term. On the other hand, if the borrower is planning to get a mortgage to pay off the construction loan, they will have to pay closing costs twice, which may be quite expensive. To calculate this construction loan you can visit .construction loan calculator only

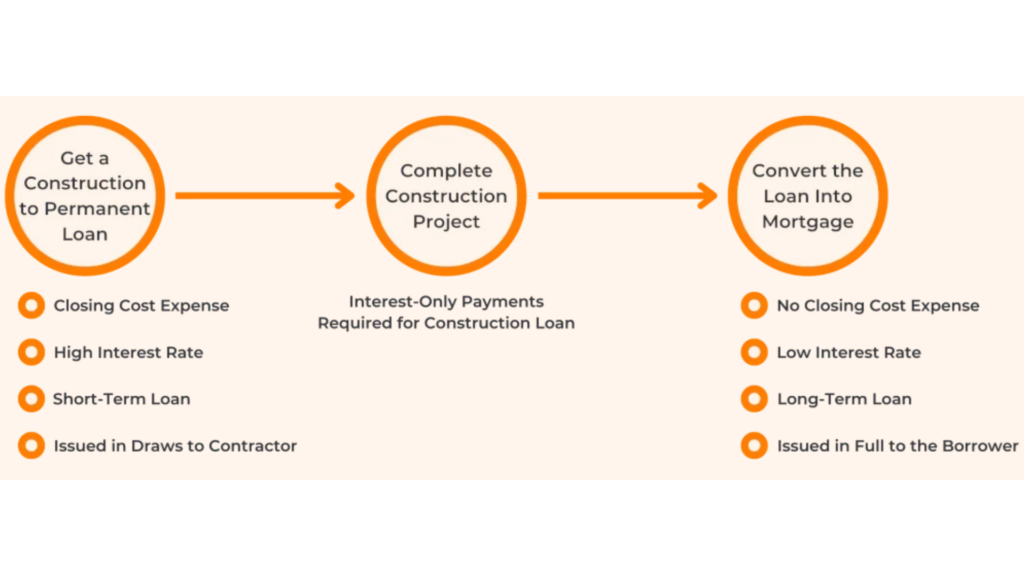

Construction-to-Permanent Loan

Construction-to-Permanent loans combine a construction loan and a mortgage in one product. It means that the borrower has to pay closing costs only once since the loan originated once. This loan has a similar structure to interest-only loans because the borrower of a construction-to-permanent loan has to pay off interest only for a specified time period and amortize the principal over years after that.

This is a good option for people who are certain that they will need to get a mortgage once the construction is complete. This type of loan allows the borrowers to avoid paying for closing costs twice, which may save up to 6% of the construction cost.

Owner-Builder Loan

Owner-Builder loan has the same structure as a construction-only loan, but an owner-builder loan does not have a contractor who works on the project and receives the money. In this case, the borrower is the builder who will oversee and work on the project. An owner-builder loan provides financing directly to the owner, but they may require certain proof that the owner is qualified to oversee the construction.

Apart from the difference in who receives the money, an owner-builder loan is very similar to a construction-only loan. A borrower has to get this loan from a lender who will provide financing in draws. Once the construction is finished, the borrower has to pay off the loan principal in full. Usually, borrowers get a mortgage to pay off the construction loan once the house is built. Since the borrower gets two separate products, they will have to pay closing costs twice.

Home Renovation Loan

This type of loan is a home improvement loan. These loans are not considered construction loans, some of them can be used to finance small projects or to cover a part of a large project. Some unbacked renovation loans are usually issued for up to $20,000, which may not be enough to build a house, but it may be enough to finish a small project such as building a staircase. On the other hand, a borrower may get backed loans such as a home equity loan or home equity line of credit (HELOC). The calculator on this page can be used as a renovation loan calculator by adjusting the inputs to reflect the renovation loan terms.

Low Down Payment Construction Loan

While the conventional construction loan requires a 20% down payment and high credit score requirements, additional options are available. Various governmental programs guarantee construction loans to provide access to everyday Americans. By backing the mortgage, lenders are more willing to accept traditionally riskier lenders. For example, you may qualify with a lower credit score or a down payment as low as 0%.

However, these programs come with additional nuances, such as maximum loan restrictions, income caps, or the need to live in rural towns. This section will dive into the three types of governmental construction loans and their qualification criteria.

| FHA | VA | USDA | |

| Minimum Down Payment | 10%/ 3.5% | 0% | 0% |

| Minimum Credit Score | 500/ 580 | N/A | 640 |

| Maximum DTI | 43% | 41% | 41% |

| Loan Size Limits | Yes | No | No |

| Income Limits | No | No | Yes |

| Additional Requirements | N/A | Veteran, or spouse of deceased veteran | Rural location |

| Fee Name | Mortgage Insurance Premium (MIP) | Funding Fee | Guarantee Fee |

FHA Construction Loan

The Federal Housing Administration (FHA) guarantees you FHA construction loans. Their primary aim is to provide financing for low to moderate-income families so they can become homeowners. The Loan is typically available with a construction-to-permanent (C2P) methodology.

However, a separate option for renovations is the FHA 203(k) loan.

An FHA construction loan allows for a minimum down payment of 3.5% with a credit score of 580. However, those with a credit score of 500 can qualify with a 10% down payment.

There are several other key requirements for an FHA construction loan:

- The borrower must have a credit score of at least 500

- The maximum debt-to-income ratio is 43%

- The property must be your primary residence

- There is a maximum loan limit that varies by county

- You must get an FHA-approved builder

- Payment of mortgage insurance premiums (MIPs)

VA Construction Loan

The Department of Veterans Affairs (VA) guarantees VA construction loans. The main aim of the VA is to help veterans, active military personnel, and their families construct homes.

A VA construction loan allows for a 0% down payment with no maximum loan limit. There are also no maximum loan amounts. However, finding a VA construction-to-permanent (C2P) loan can be challenging. Instead, you may find a VA construction-only loan that you can then refinance into a standard VA mortgage.

Other key requirements for a VA construction loan include the following:

- The maximum debt-to-income ratio is 41%

- Have a Certificate of Eligibility (COE)

- the property must be for your primary residence

- You must get a VA-approved builder

- Payment of VA funding fee

USDA Construction Loan

The US Department of Agriculture (USDA) issues USDA construction loans through their Rural Development Housing and Community Facilities Program. This program aims to improve the quality of life in rural areas by providing affordable financing.

The USDA offers different types of construction loans. One of the most popular USDA construction loans is the USDA Single Close Construction Loan. It is a Construction-to-Permanent loan, which means that the borrower needs to pay for closing costs only once.

This program is designed to construct rural homes with a 0% down payment. However, due to strict requirements, few lenders and builders partner with the program. As a result, you may need to begin with a conventional construction loan and refinance it into a 30-year USDA mortgage.

Other key requirements of the USDA program include the following:

- You must exceed a 640 minimum credit score

- There is a maximum debt-to-income ratio is 41%

- You must use the home as your primary residence

- You must meet regional income requirements

- The property must be located in a USDA-designated rural area

- Payment of USDA guarantee fees

Frequently Asked Questions

How Do I Estimate Construction Costs?

Estimating the construction cost means simply finding out how much it costs to build a house. There are several factors that contribute to the construction cost of a house:

1.Land – You first need to purchase land on which you will build your house on. The cost of the land can range anywhere from $5,000 – $150,000 depending on the square footage and location. You can estimate the cost of land financing by using a land loan calculator.

2.Site Work – This includes costs for grading, excavation, construction and anything that is not related to building the physical structure of the house. The cost to do site work can range from $2,000 – $6,000. The exact cost will depend on the size of the land and the condition it is in.

3.Floor Plan – You will have to design the layout of the house, its rooms, bathrooms, kitchen, either on your own or with the help of an architect. This can cost you $2,000 to $5,000.

4.Foundation – The cost of foundation includes the material and labor for breaking ground on your new home. Depending on the type of foundation, the bill can be from $5,000 to $25,000.

5.Framing – One of the more hefty costs, framing includes building the outer structure of the house by fitting together pieces for support. The cost of framing a house will depend on the size of the house and the materials used, however, on average, it costs $20,000 to $50,000 to frame an entire house.

6.Exterior – Building the exterior of a house means covering the entire area of the house that is exposed to the outside. The exterior can cost $30,000 to $55,000.

7.System Installation – The systems may include the HVAC system, the electrical and the plumbing system. Each of these systems on their own come at a high cost. Therefore, the total cost of system installation can go up to $75,000.

8.Interiors – The interior part of a house includes everything inside the home from flooring, painting, and insulation to appliances and plumbing features. Building the structure and exterior is only one part of the job, so be prepared to spend a substantial amount of money and time inside the home as well. The cost of the interiors will depend on the materials and appliances that you choose to use. However, prices range from $50,000 to $150,000.

By allocating how much money you will spend on each category of costs and adding them up, you will get a rough estimate of what construction will cost you.

Is a Construction Loan Harder to Get Than a Mortgage?

It is harder to get a construction loan than a mortgage. Construction loans are also more expensive than mortgages. Construction loans are considered riskier than mortgages because the house that plays the role of collateral, is not yet built. Lenders are more cautious about approving construction loans. They require more documentation, including a clear plan of how and when the house will be built, and information about a general contractor managing the project. Many lenders may also require a larger down payment and set a higher interest rate than they would for a mortgage.